Fake agent scams are on the rise across Canada and worldwide. Criminals are impersonating trusted companies in telecommunications, banking, insurance, and retail to steal your money and personal information. Understanding how these scams work — and knowing the warning signs — is crucial to protecting yourself.

Understanding the Fake Agent Scam

Fraudsters often impersonate company representatives to gain your trust and steal your personal information, money, or identity. These scams can occur across any industry where customer service interactions are common. By recognizing the warning signs, you can avoid falling victim to these schemes.

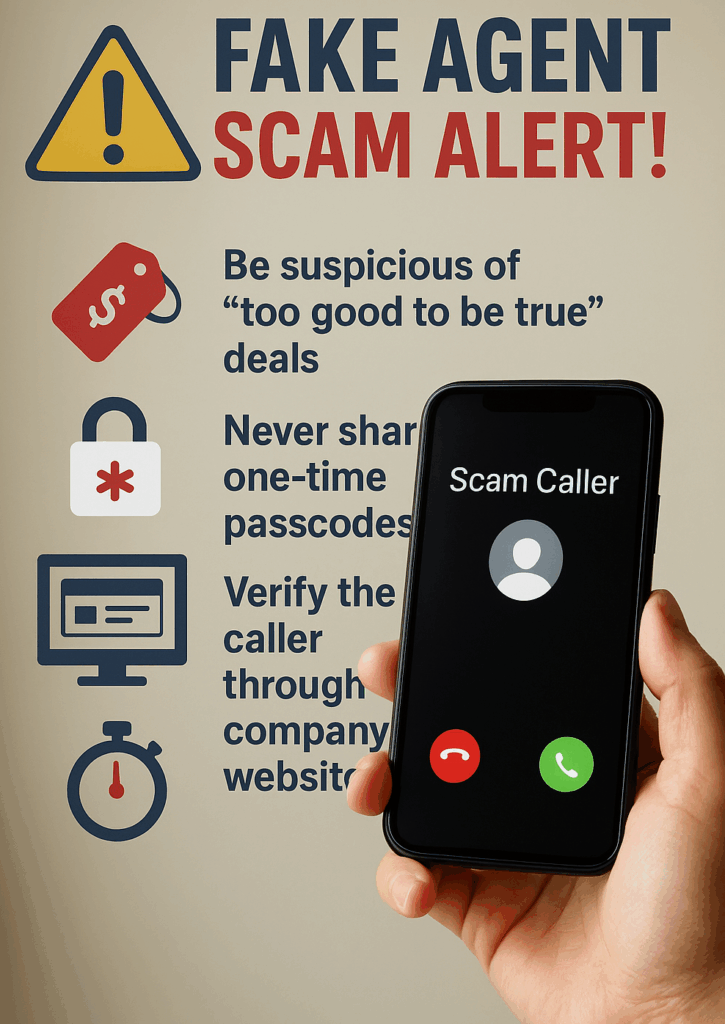

Common Red Flags to Watch For

Offers That Seem Too Good to Be True

If someone contacts you claiming to represent a company and offers an unrealistic deal—whether it’s an exceptionally low price, exclusive access to products, or services at a fraction of the normal cost—exercise caution. Legitimate businesses rarely offer significant discounts or promotions through unsolicited contact.

Bait-and-Switch Tactics

You may receive products or services that don’t match what was initially promised. This discrepancy is often a sign of fraud. If something doesn’t align with your expectations or what was agreed upon, contact the company directly using verified contact information to confirm the legitimacy of the transaction.

Suspicious Delivery or Service Processes

Be wary of unusual instructions regarding returns, deliveries, or service appointments. Scammers may provide false addresses, request unconventional payment methods, or direct you to unauthorized locations. Always verify return addresses, service centers, and delivery instructions through the company’s official website or customer service line.

Requests for One-Time Passcodes or Verification Codes

Legitimate companies will never ask you to share authentication codes, one-time passcodes (OTPs), or security tokens over the phone or by text message. These codes are designed to protect your account and should never be shared with anyone — even someone claiming to be from the company.

Suspicious Messages or Communications

Fraudulent texts, emails, or calls often contain spelling errors, unusual formatting, or urgent requests for immediate action. If you receive questionable communications, report them to your service provider or the company being impersonated. Many organizations have dedicated channels for reporting suspicious activity.

Additional Warning Signs of Fraud

Unsolicited Requests for Personal Information

If you didn’t initiate contact with a company, be extremely cautious about sharing personal or financial details. Legitimate businesses won’t call, text, or email to ask for sensitive information, such as passwords, social security numbers, credit card details, or account credentials.

Selling You What You Already Have

Scammers may try to convince you to purchase services you already subscribe to or encourage you to switch to competitor services through high-pressure tactics. Authentic representatives typically don’t cold-call customers to upsell current services or promote competitors.

Something Feels Wrong

Trust your instincts. If an interaction feels unusual, rushed, or suspicious in any way, it’s better to be cautious. End the conversation politely and contact the company directly using official information from their website or documentation.

How to Protect Yourself

Verify Before You Trust: If someone claims to represent a company, hang up and call the organization directly using a phone number from their official website or account statements.

Never Share Sensitive Information: Don’t provide passwords, authentication codes, financial details, or personal information to unsolicited callers or message senders.

Take Your Time: Scammers create urgency to prevent you from thinking clearly. Legitimate companies will give you time to make informed decisions.

Use Official Channels: Always conduct transactions and communications through verified company websites, apps, or official service lines.

Report Suspicious Activity: If you suspect fraud, report it immediately to the company and the relevant authorities. Your vigilance can help protect others.

The Consequences of Ignoring Fraud

Failing to address fraudulent activity promptly can lead to serious consequences, including identity theft, financial loss, unauthorized account access, and compromised personal security. These impacts can extend to your family members and take considerable time and resources to resolve.

Taking Action

If you suspect you’ve been targeted by a fake agent scam or notice unusual activity on your accounts:

- Contact the company immediately through official channels

- Change your passwords and security settings

- Monitor your financial statements and credit reports

- File a report with local law enforcement or consumer protection agencies

- Alert your financial institutions if payment information was compromised

Remember: staying informed and vigilant is your strongest defence against fraud. When in doubt, verify independently and trust your instincts. No legitimate company will pressure you into sharing sensitive information or making immediate decisions through unsolicited contact.